In today’s fast-paced world, managing your money can be challenging. From daily expenses to monthly bills and long-term savings, it’s easy to lose track of where your money goes. Budgeting and expense tracking apps have become essential tools to help people understand their financial habits, stay on budget, and achieve their financial goals. Below are five of the most reliable and user-friendly apps to help you gain better control over your finances.

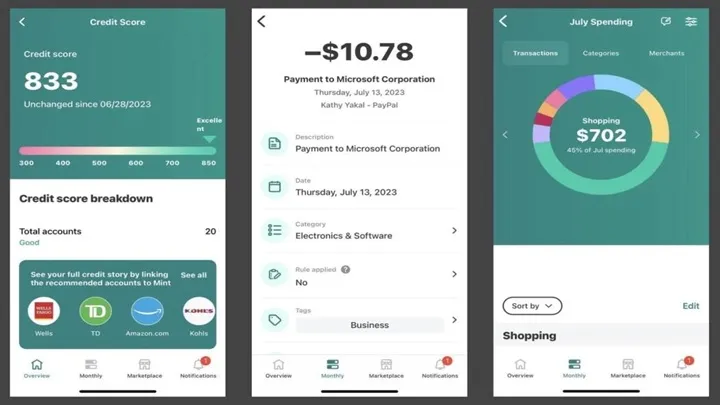

1. Mint – Your All-in-One Finance Tracker

Mint is one of the most popular budgeting apps in the world, known for its simplicity and powerful features.

- Automatic syncing with bank accounts makes it easy to track all your transactions in one place.

- Creates personalized budgets based on your spending habits.

- Provides real-time bill reminders and tracks your credit score.

- Perfect for individuals who want a free, hands-off solution to monitor their spending.

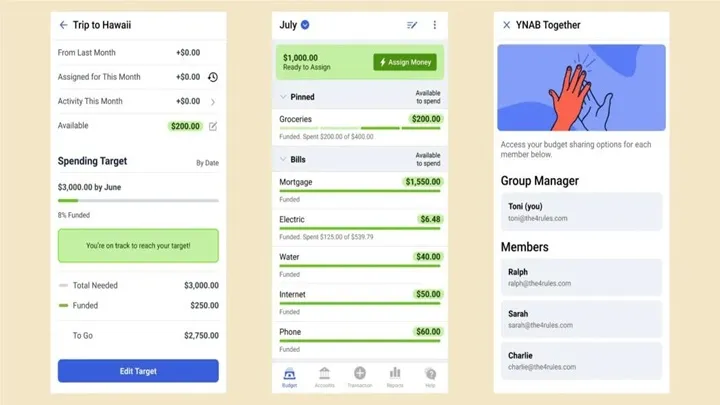

2. YNAB (You Need A Budget) – A Proactive Approach to Budgeting

YNAB focuses on giving every dollar a purpose.

- Helps you plan your money before you spend it, not after.

- Includes goal tracking tools for saving, debt reduction, and investment planning.

- Provides educational resources and workshops to improve your money management skills.

- Best suited for people who want to develop disciplined financial habits over time.

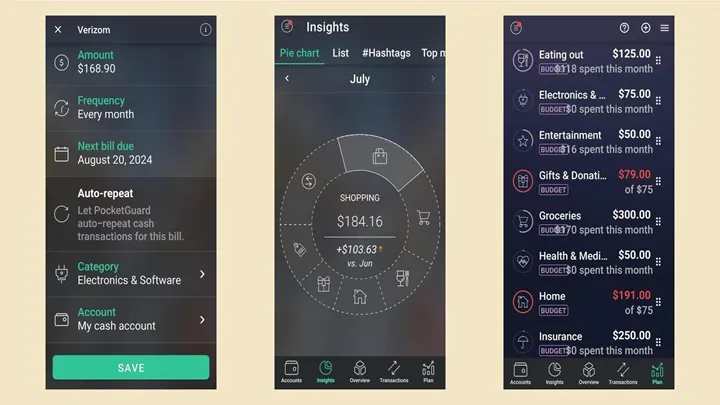

3. PocketGuard – Know What You Can Spend

PocketGuard is designed for those who want clarity on their disposable income.

- Tracks income, recurring bills, and subscriptions automatically.

- Shows how much “In My Pocket” money you have left after essentials.

- Easy interface makes it ideal for beginners or busy professionals.

- Offers tips on cutting down unnecessary expenses and boosting savings.

4. Goodbudget – The Digital Envelope System

Inspired by the classic envelope budgeting method.

- Allows you to allocate funds into digital envelopes (e.g., groceries, entertainment, savings).

- Perfect for couples or families as it supports syncing across multiple devices.

- Requires manual input for expenses, giving you more conscious control over your spending.

- Great for people who prefer a hands-on approach.

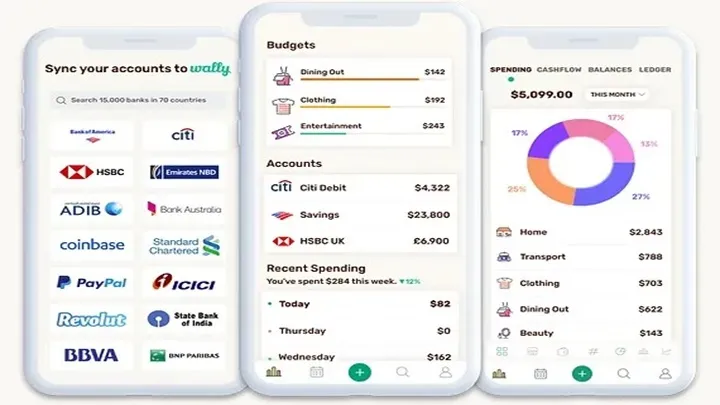

5. Wally – For the Detail-Oriented Spender

Wally combines smart design with powerful analytics.

- Tracks income, expenses, and receipts in one place.

- Supports multiple currencies, making it ideal for travelers or freelancers.

- Generates detailed spending reports to help you see where your money really goes.

- Includes features for goal setting and shared finances.

Why These Apps Are Game-Changers

Each of these apps is designed to make money management simpler and more effective. They help you understand your spending patterns, cut unnecessary costs, and focus on financial goals like building an emergency fund, saving for a trip, or paying off debt. Whether you want something simple and automated like Mint or a more hands-on system like Goodbudget, there’s an app here for everyone.